India Entry Services

Many overseas companies fail to grasp the complex intricacies of business in India and soon find themselves entangled in ambiguities, extortionate cost and time consuming bureaucracy. We at Crescita Consultancy assist foreign companies in mitigating the risks associated with entering the Indian market and operating successfully without succumbing to challenges. With our pre-market entry services to post operational excellence we serve as a unique platform for global companies by acting as a single window service provider supporting the India market entry and ongoing successful business development.

Our strength is in bringing people & business together and providing a complete range of on-the-ground services ranging from all kind of regulatory support to smallest of logistic arrangement.

We don’t only advise the clients but do the work for them and with them – as their partners for growth and success. Our Motto – ‘Your Growth, Our Passion’India Entry Services Includes:

India Entry Level strategies.

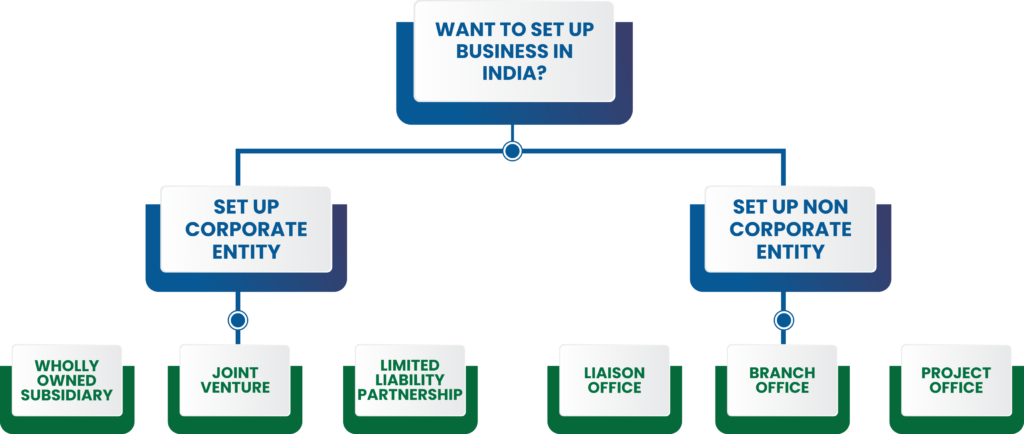

Incorporation service includes evaluating and developing the India entry level strategies. Various options such as Liaison Office (LO), Branch Office (BO), Project Office (PO), Subsidiary and/ or Joint Venture company in India are evaluated from legal, tax and regulatory viewpoint.

Incorporation Services

Company/ LLP/ Other forms of Entity Incorporation or Set up Services

- Applying for Digital Signatures of Proposed Directors/ Proposed Designated Partner / Authorized Signatory

- Applying for Director Identification Number (DIN) / Designated Partner Identification Number (DPIN) of Proposed Directors/ Proposed Designated Partner

- Ascertaining the availability of proposed name

- Preparation of the Memorandum of Association (‘MOA’) and Articles of Association (‘AOA’)/ LLP Agreement

- Filing to Ministry of Corporate Affair company incorporation documents and obtaining Certificate of Incorporation.

- Preparing application for Liaison Office (LO), Branch Office (BO), Project Office (PO) to be submitted to Reserve Bank of India via Authorized Dealer Bank

- Obtaining Permanent Account Number (PAN) and Tax Deduction Account Number (TAN) of newly incorporated entity

One Time Registrations

- GST (Goods and Service Tax) Registration

Goods and Service Tax is indirect tax which got implemented in July 2017. GST subsumed service tax, Value Added Tax and other indirect taxes in India.

- Importer-Exporter Code (‘IEC’) (If Applicable)

IEC Code is mandatory to import or export in/from India.

- Shops & Commercial Establishments Acts Registration

As per respective state Shops and Commercial Establishments Acts, registration of Commercial Establishments is mandatory. This Act regulates the conditions of service of employees employed in shops and commercial establishment i.e. hours of work, rest hours, opening and closing hours, weekly off and maintenance of record by the employers.

- Employees’ Provident Fund (EPF) Registration

EPF scheme is to promote retirement savings for employees across India. The Employees’ Provident Fund (EPF) is a corpus of funds built through regular, monthly, contributions made by an employee and his/her employer. The amount contributed to the fund is a fixed rate.

- Employees’ Estate Insurance Scheme Registration

Employees’ State Insurance Scheme of India, is a multidimensional social security system tailored to provide socio-economic protection to worker population and their dependants covered under the scheme.

- Professional Tax

Professional Tax is a state tax, imposed by a state government on account of the infrastructure it provides to carry out profession. Professional Tax is deducted by the employer from the salaries of employees every month and remitted to the state.

- Labour Identification Number (LIN).

The Unified Shram Suvidha Portal has been envisaged as a single point of contact between employer, employee and enforcement agencies bringing in transparency in their day-to-day interactions. For integration of data among various enforcement agencies, each inspectable unit under any Labour Law has been assigned one Labour Identification Number (LIN).

Compliance matters – RBI (Foreign Exchange Management Act)

- Intimation to the RBI, within 30 days of the remittance along with the copies of the Foreign Inward Remittance Certificate obtained from the receiving banker in respect of the funds received.

- Filing particulars of the allotment to RBI within 30 days of allotment of shares, along with compliance certificate from a practicing Company Secretary.

Assistance in Opening Bank Account in India

- Drafting appropriate Board Resolution and required documents

- Liaison with bank and ensuring timely action by the concerned bank

On Going Services

Direct Taxation

- Advising on Tax Planning in order to reduce tax burden in India (Regularly).

- Preparation of draft computation of Income and finalization (Annual).

- Preparation and filing of Corporate Tax Return (Annual).

- Calculation of Advance Tax payment (Quarterly).Corporate Compliance

Direct Taxation – Withholding Tax

- Routine Advisory in respect of commercial transactions in terms of applicability of tax withholding including DTAA (Regularly)

- Verifying compliances in respect of tax withholding for non-salary payments (monthly)

- Preparation of tax challan and deposit of taxes with Income tax authorities (monthly)

- Preparation and filing of quarterly returns with Income tax authorities of Withholding Tax (Quarterly)

- Issue of Form 16A to vendors (Quarterly)

In-Direct Taxation – GST

- Verifying compliances in respect of GST including reverse charge mechanism (monthly).

- Verifying availability of GST credit (monthly)

- Performing reconciliation of GSRT 2A / 2B with Books of Accounts

- Computation of monthly liability of tax and deposit of the same with tax authorities (monthly)

- Preparation and filing of Monthly return (GSTR 1 and GSTR 3B) of with tax authorities (Monthly)

- Applying for GST Refund Processing if any.

Payroll Process

- Preparation or review of salary structures of the employees for the financial year, estimating the annual tax liability of each employee (1 Time /Year (April & March))

- Obtaining declaration from employees for proposed savings to be done by them in the financial year for tax savings (Beginning of the year or at the time of joining of the employee)

- Obtaining proof of investments made by the employees for savings done by them during the financial year for tax savings (February ~ March)

- Processing of monthly payroll from the data provided by management and intimating bankers for final remittance to employees’ accounts (Monthly)

- Preparation of salary slips to employees (Monthly)

- Deduction of applicable taxes on employees’ salary and preparation of tax challan for deposit and deposit the same with government authorities: (Monthly)

- Preparation and filing of quarterly returns with Income Tax authorities for tax withholding (Quarterly)

- Issue of Form 16 to the employees (Annual)

Accounting Services

- Setting up initial chart of accounts in conformity with Indian GAAP and management reporting requirements.

- Collection of accounting and finance documents along with the copy of contract/ agreement with respective parties

- Maintenance of books of accounts in accordance with Indian GAAP and considering the policies and procedures laid down by the management

- Preparation of vendor payment details

- Preparation of Withholding Tax (TDS) liability sheet

- Preparation of GST tax liability sheet

- Preparation of Bank Reconciliation Statement on regular basis.

Audit and Assurance

- Assisting in Financial Statement Audit as per instruction from Head Office.

- Assisting in Statutory Audit as per Indian Regulations.

- Interaction with the Parent company auditor and review of financial pack.

- Assisting in Tax audit as prescribed under the Indian Income Tax Act,

- Assisting in GST Compliance under GST Act including preparation of Form 9

Reporting to Holding Company

- Preparing Monthly MIS and reporting to Holding Company as per International Financial Reporting Standards (IFRS) (Monthly)

Compliance matters – Corporate Affairs

- Keeping Eye of frequent changes in Company Act and its requirements to ensure company is fully compliant. To give example, Company Act has recently initiated following compliance –

- Director KYC

- Active Form

- MSME Form

- DPT 3

- Submission of Statutory Returns (Annual) includes

- Preparation of director report

- Approval of adoption of accounts and director report

- Annual return filing including financial statements

- Compliance certificate if applicable

- Appointment of Auditor

- KYC of Directors

- KYC of company

- Holding and Drafting of Minutes of meeting & board resolution (Atleast once in a quarter)

- Maintenance of statutory register as required under law (Regular)

- Drafting mandatory resolution passed in board meeting of the year

- Filing documents with Registrar of Company (As may be required). Few common ones are listed below

- Appointment /cessation of Directors,

- Increase in authorised capital,

- Issues of shares

Compliance matters – RBI (Foreign Exchange Management Act)

- Filing applications/ forms relating to Foreign Direct Investment in India to Reserve Bank of India (RBI) (As may be required)

- Preparation and filing of Statement of Foreign Liabilities and Assets with RBI (Annually)

- Issuing of CA certificate for making foreign remittance (As may be required).

Banking and Financial Advisory

- Liaison with banks to ensure smooth functioning of the business (Regular).

- Advising on ways to operate banks in India to mitigate risk of fraud (Regular).

- Advise on the most beneficial process for repatriation of income from India, considering changing government regulations on such matters from time to time (As may be required)

- Issue mandatory Chartered Accountant certification for RBI compliance purposes on every repatriation transaction (As may be required).

Resident/ Independent Director

- Provision of a local resident/ independent director to oversee Indian Accounting, Tax and Regulatory compliances. (Regular)

- Ensuring compliance with Company Act 2013 and safeguarding directors of the company from any penalty. (Regular)

- Attending board meetings (Quarterly)

- Attend meetings with Indian business partners, bankers, employees, clients/ customers. (As may be required).

Internal Controls/ General Advisory (Regular)

- Advising controls to mitigate financial and other risk to Business in India.

- Giving second review to all kinds of agreements, licenses or deeds (shareholders, JV, profit-sharing, franchisee, sales, purchase) based on Indian law, keeping commercial / Taxation focus.

Registered / Communication Address

- Giving our office address as registered address during company formation. (Registered address can be changed anytime)

- Receiving official letter and forwarding the same to authorized representative.

- Entertaining tax official / others visiting the registered office of the company.